With Spring Showers Comes the ‘She-Cession’: Keeping the Plates of Working Motherhood Spinning in the Midst of a Pandemic

Inspired by Maria Shriver’s investigative report for 3rd Hour Today, The State of Women: She-Cession. The month of March typically fills our calendars with the return of spring weather, spring-cleaning, spring training and spring break, but this year, March also marks one year since the World Heal

Success Can Look Like a Number, Especially if it’s 6-Figures

As a community of women who have come together with the same common goal of enhancing our lives, we each have our own individual WHY that keeps us progressing forward toward that goal. And, while we each have our own perspective of success that we aspire to achieve, we all agree that attaining

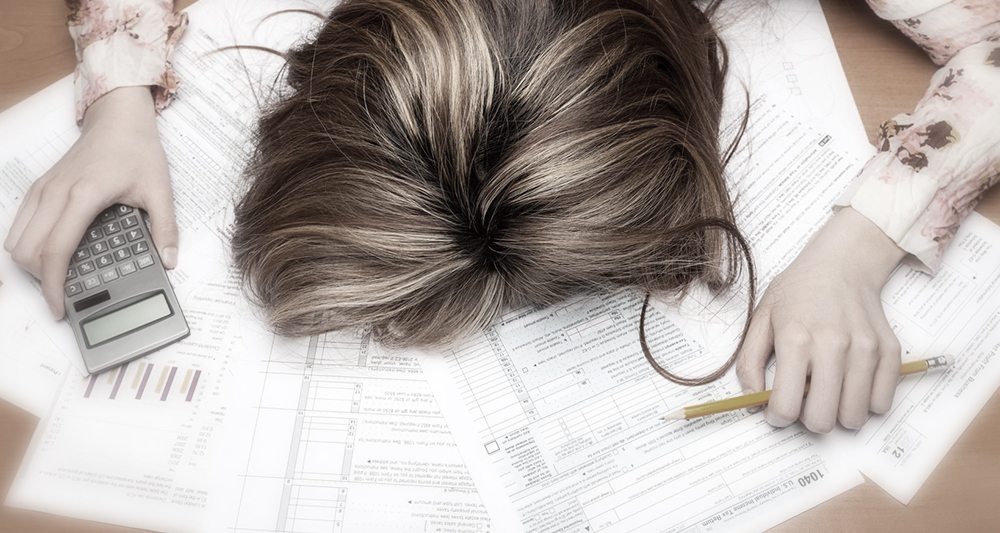

Simple Ways to Manage Expenses So Tax Write-Offs Are Easy

Life is expensive—and even more so when you have kids. Does it seem like your expenses just keep piling up? Wouldn’t it be nice to easily locate permissible tax write-offs come tax season? Now that it’s a new year, it’s a good time to take charge of and manage your expenses. We all know the

Simple Steps for Working Moms to Become Debt Free

Being Debt Free – Oh the Freedom! “I’m in debt. I am a true American.” – Balki Bartokomous Many of us aspire to get ahead in life, but then things happen—it seems like, no matter our financial situation, debt sneaks into our lives and holds us back. Just when you think you’ve got some

No Budget? You’re Probably Spending More Than You Think.

Wow! Congratulations for taking the step reading this post! Most people hear the word “budget” and run as far away as possible, as quickly as possible! Why is that? Is it because when we hear the word we immediately think of restrictions and going without things we want? What if instead the word

What are you teaching your children about money?

As parents, we intuitively recognize that teaching life skills is our responsibility. As such, we teach our children manners by constantly reminding them to use simple phrases such as “please” and “thank you.” We teach them about faith and God by reading the bible with them and praying befor

Stacy’s Story: The Stress of Debt and Steps to Financial Freedom

Can you imagine what it would feel like to never owe anyone a single dollar? Honestly, can you even imagine NEVER being in debt for a single day of your life? Sadly, I am finding the answer to this question for most people is a resounding “No!” And I have to admit that growing up […]