Improve Your Focus and Outperform the Hardest Worker in the Room: You

Inspired by this week’s Moms Making Six Figures Podcast episode with Laurel Hamblin, an incredibly successful realtor in the Treasure Valley at the young age of twenty-three, who credits her success to her pursuit of personal growth and the time she invested in herself and her career by taking the

The Practical Perks of Involving Your Children in Your Business

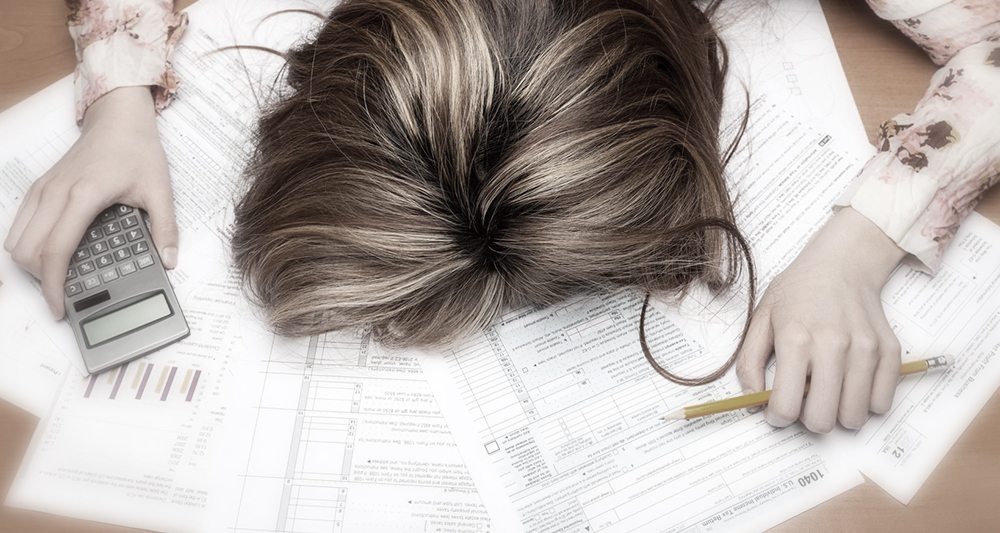

Inspired by this week’s Moms Making Six Figures Podcast episode with Tax Strategist Jessica Smith who believes in making your money work as hard for you as you work for it, all while giving our children the gift of practical experience and work ethic. I can still remember my first job. There

Simple Ways to Manage Expenses So Tax Write-Offs Are Easy

Life is expensive—and even more so when you have kids. Does it seem like your expenses just keep piling up? Wouldn’t it be nice to easily locate permissible tax write-offs come tax season? Now that it’s a new year, it’s a good time to take charge of and manage your expenses. We all know the